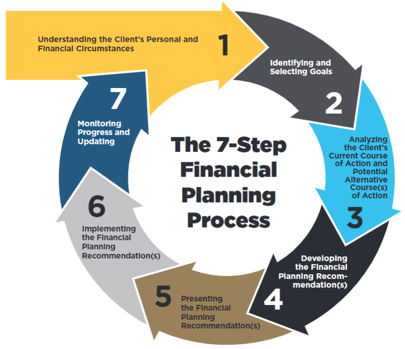

A Proven 7-Step Process

At Ford Wealth Management, we follow a proven 7-Step Financial Planning Process designed to bring clarity, confidence, and direction to every financial decision you make.

Each step builds on the last, creating a thoughtful, coordinated plan tailored to your life — not just your finances. This isn’t a one-time transaction. It’s an ongoing partnership designed to evolve with you.

Step 1: Understanding Your Full Financial Picture

Every relationship begins with listening.

We take the time to understand your complete financial and personal situation — including income, assets, liabilities, family dynamics, values, and priorities. This discovery process allows us to see the full picture before making any recommendations.

Outcome: A clear understanding of where you are today and what matters most to you

Step 2: Clarifying and Prioritizing Your Goals

Next, we help you define what financial success looks like — for today and for the future.

Whether your goals include retirement, education planning, business transitions, or lifestyle flexibility, we help clarify your vision and prioritize what’s most important.

Outcome: Clearly defined goals with purpose and direction.

Step 3: Analyze Your Current Path

We evaluate whether your current financial strategies are aligned with your goals.

This includes reviewing investments, cash flow, risk management, taxes, retirement readiness, and estate considerations to identify strengths, gaps, and opportunities.

Outcome: Insight into what’s working, what isn’t, and where improvements can be made.

Using everything we’ve learned, we create a customized financial plan with clear, actionable recommendations.

Your plan integrates all areas of your financial life — investments, retirement, taxes, insurance, and estate planning — into one coordinated strategy.

Outcome: A roadmap designed to move you forward with intention and confidence

Step 4: Developing Your Personalized Financial Plan

We walk you through the plan step by step.

Our goal is to ensure you fully understand your options and feel confident in the recommendations. No jargon. No pressure. Just thoughtful guidance and clear explanations.

Outcome: Confidence in your plan and clarity around next steps

Step 5: Presenting and Explaining the Plan

Once you’re comfortable, we help put the plan into action.

We coordinate implementation, collaborate with your CPA and other professionals as needed, and ensure each piece is executed properly and efficiently.

Outcome: Your strategy moves from plan to reality — without unnecessary complexity.

Step 6: Implementing the Plan

Step 7: Ongoing Monitoring and Adjustments

Life changes — and your financial plan should change with it.

We meet regularly to review progress, track results, and make adjustments as your goals, circumstances, or the financial landscape evolve.

Outcome: A plan that stays relevant, resilient, and aligned with your life..

Let’s Build a Better Financial Future

Our process is built on trust, transparency, and personalized advice.

We’re here to be your long-term partner — not just for today, but for every step ahead.